Beyond the Billable Hour: A Freelancer's Guide to Tracking Business Expenses

Published on: by: Chip Olson

Remember that moment you decided to go freelance? The vision was probably crystal clear: creating amazing work on your own terms, maybe from a cozy home office with a perfectly curated playlist and an endless supply of good coffee. It’s a beautiful, worthwhile dream.

And then, reality hits. Not the work part—you’re brilliant at that. I’m talking about the business part. The part where you’re not just a creator, but also the CEO, CFO, and head of accounting. Let's be real: adulting is hard, and freelance adulting is next-level. Suddenly, you're staring at a spreadsheet, wondering if your oat milk latte counts as a business expense. (Spoiler: it sometimes can!)

This is where the real journey begins. It’s the journey of not just being a great freelancer, but a smart business owner. And it starts with understanding a topic that seems boring on the surface but is actually an act of radical self-care: tracking your expenses.

Why Tracking Expenses is Non-Negotiable (It's About More Than Taxes!)

When we talk about freelance finances, everyone focuses on the income—the exciting part! But your expenses tell the other half of your business's story. They are the foundation of your financial well-being. Getting a handle on them is non-negotiable, and here’s the real why:

- It Informs Your True Worth: You can't set a profitable rate if you don't know what it costs to run your business. Tracking expenses is the secret weapon that fuels our Freelance Hourly Rate Calculator. It turns a guess into an educated, data-driven starting point.

- It Builds a Sustainable Career: Ignoring expenses is the fastest path to burnout. It leads to undercharging, financial stress, and that dreaded feast-or-famine cycle. Knowing your numbers helps you build a business that lasts.

- It Lowers Your Tax Bill (Seriously): As a US freelancer, every dollar you identify as a legitimate business expense is a dollar you don't pay income and self-employment taxes on. It's not about finding loopholes; it's about claiming what you're rightfully owed.

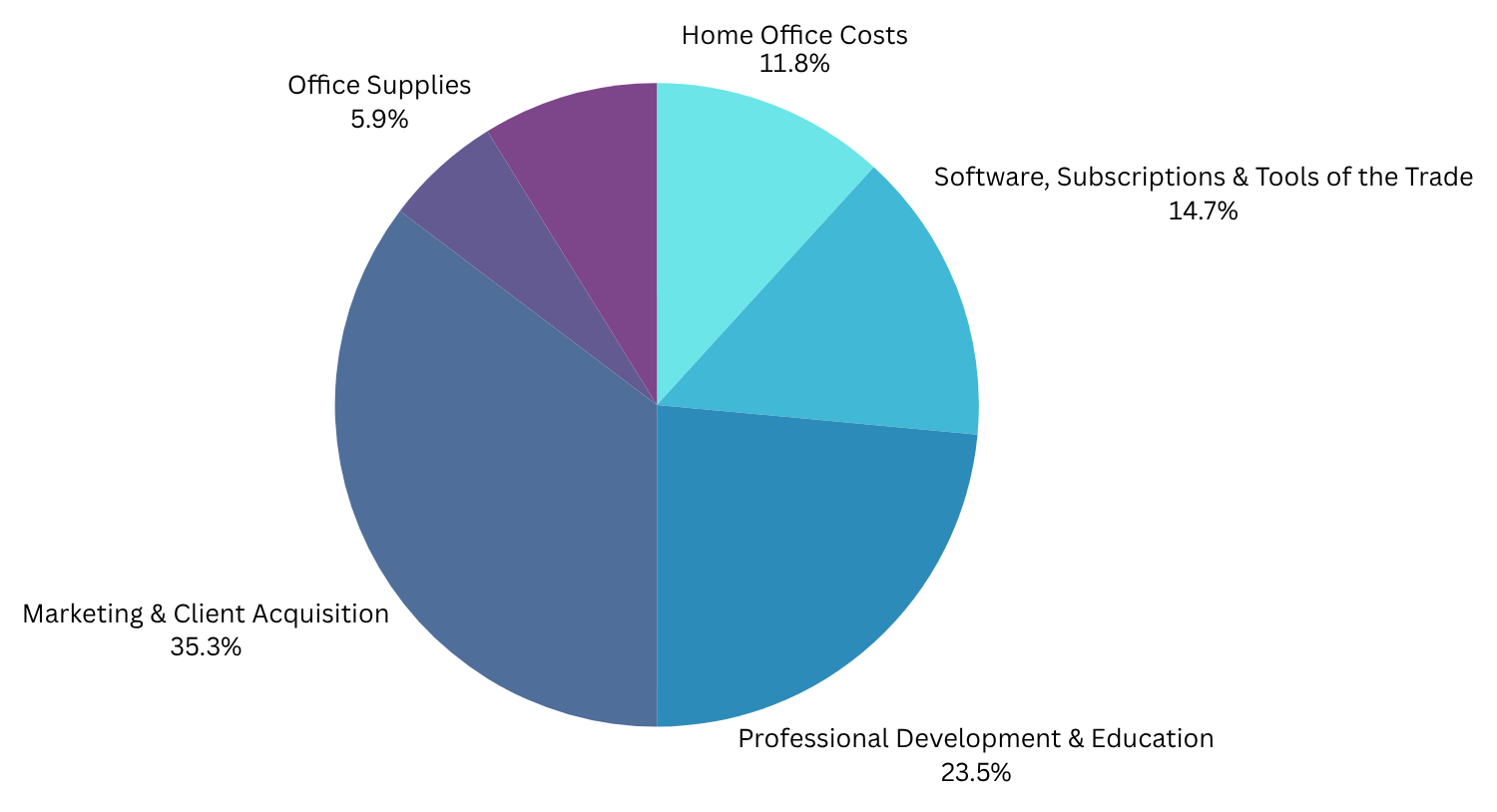

Your Freelance Expense Cheat Sheet (A Checklist)

So, what actually is a business expense? Here are some of the most common categories for US freelancers. Think of this as your treasure map to finding hidden savings.

Home Office Costs

That cozy corner of your world where the magic happens? A portion of it is a business expense. This can include a percentage of your rent/mortgage interest, utilities, and internet bill based on the square footage of your dedicated workspace. The IRS has specific rules, so research the "Simplified Option" vs. the "Regular Method."

Software, Subscriptions & Tools of the Trade

All those subscriptions that feel like they're nibbling away at your bank account? It's time for them to earn their keep!

- Creative Software: Adobe Creative Cloud, Figma, etc.

- Productivity & Project Management: Asana, Trello, Notion.

- Accounting & Invoicing: QuickBooks, FreshBooks, etc.

- Website & Marketing: Your domain name, website hosting, email marketing services.

Professional Development & Education

Investing in yourself is investing in your business.

- Courses & Workshops: That online course you bought to level up your skills.

- Conferences & Events: Both virtual and in-person.

- Industry Books & Publications: Subscriptions to trade journals.

- Memberships: Dues for professional organizations.

Marketing & Client Acquisition

How you get the word out about your amazing work.

- Online Advertising: Google Ads, social media ads.

- Networking Events: The cost of attending local meetups.

- Business Cards & Promotional Materials.

Office Supplies

From the big stuff to the small, it all adds up.

- Hardware: A portion of your new laptop, monitor, or keyboard.

- General Supplies: Pens, paper, planners, hard drives.

Professional Services

You don’t have to do it all alone!

- Accountant/Bookkeeper Fees.

- Legal Fees for contract review.

- Business Coaching or Consulting.

Level Up Your Tracking Game

Okay, so you know what to track. But how?

- Level 1: The Trusty Spreadsheet. When you're just starting, a simple Google Sheet or Excel file is perfect. Create columns for the date, vendor, description, category, and amount. It’s free and it builds the habit.

- Level 2: The Pro-Level Power-Up. As you grow, manual tracking gets tedious. Graduating to accounting software is a game-changer. Tools like QuickBooks Self-Employed or FreshBooks can link to your business bank account, automatically categorize expenses, scan receipts, and make tax time infinitely less stressful.

Your Journey, Your Numbers

Building a freelance career is one of the most rewarding journeys you can take. It’s about creating a life on your own terms. Taking control of your finances by diligently tracking your expenses is a fundamental part of that journey. It transforms you from just a creator into a confident business owner.

You've got this.

With heart, Avery Carter