Freelance Launchpad: Your First 90 Days Checklist

Published on: by: Chip Olson

Starting your freelance journey is an incredibly exciting time! You're taking control of your career, pursuing your passion, and building something from the ground up. However, those initial months can also feel overwhelming with so much to figure out. Where do you even begin?

This "Freelance Launchpad" checklist is designed to guide you through the essential steps for your first 90 days. Think of it as your roadmap to successfully setting up your business, organizing your finances, and landing those important first clients. Let's dive in!

Phase 1: Laying the Groundwork (Days 1-30) – Business Setup & Basics

The first month is all about establishing a solid foundation for your freelance business.

1. Define Your Niche & Services Clearly:

- What specific services will you offer?

- Who is your ideal client?

- Niching down can make it easier to market yourself and attract the right opportunities.

- Action: Write a concise statement describing your services and target audience.

2. Choose Your Business Name:

- Select a name that is professional, memorable, and (if possible) reflects your services.

- Action: Brainstorm names. Check if the name (and desired domain/social handles) is available.

3. Understand Basic Legal Requirements (US Focus):

- Sole Proprietorship: For most new US freelancers, operating as a sole proprietor is the simplest structure. You and your business are legally the same entity.

- EIN (Employer Identification Number): Consider getting an EIN from the IRS (it's free!). You can use this instead of your Social Security Number for business purposes, which adds a layer of privacy.

- Action: Research if an EIN is right for you and apply on the IRS website if needed.

- Disclaimer: This is not legal advice. Consult with a legal professional for guidance specific to your situation and location.

4. Open a Separate Business Bank Account:

- Keeping your business and personal finances separate from day one is crucial.

- Don't blur the lines between your wallet and your business!

- Safeguard your personal assets.

- Simplify bookkeeping and taxes.

- Gain unparalleled clarity in your financial management.

- Effortlessly track every dollar.

- Action: Research banks offering business accounts suitable for freelancers and open one.

5. Set Up Basic Income & Expense Tracking:

- You don't need fancy software immediately. A simple spreadsheet (Google Sheets, Excel) can work to start.

- Action: Create a spreadsheet with columns for: Date, Client/Vendor, Description, Income, Expense Category, Amount. Start logging everything.

Phase 2: Financial Foundations & Getting Seen (Days 31-60)

Month two focuses on your financial preparedness and making your new business visible.

6. Estimate Your Startup Costs & Monthly Living Expenses:

- What do you need to spend to get started (software, one-time fees)? What are your non-negotiable personal monthly expenses? Knowing these figures is vital.

- Action: List all potential startup costs and track your personal budget.

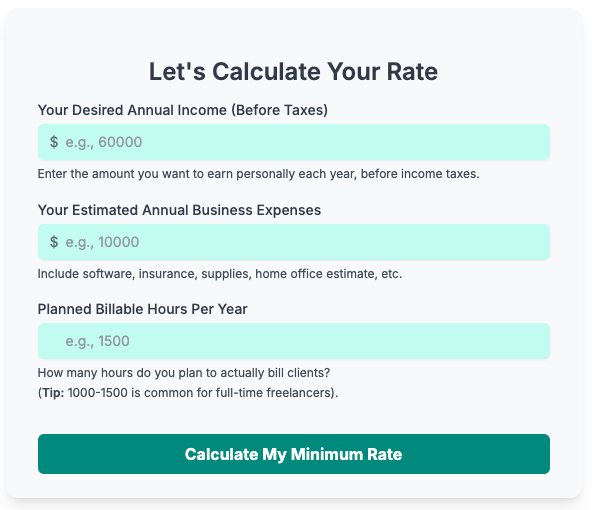

7. Calculate Your Baseline Hourly Rate:

- This is where the magic happens! Knowing your income goals and expenses allows you to determine a minimum viable hourly rate. This isn't necessarily your final market rate, but it's the rate you need to survive and thrive.

- Action: Use our Freelance Hourly Rate Calculator to determine your baseline. It factors in your desired income, business expenses, and even an estimate for US Self-Employment taxes.

8. Create a Basic Portfolio or Online Presence:

- You need a place to showcase your skills. This could be:

- A simple one-page website.

- An updated LinkedIn profile optimized for freelancing.

- A profile on a platform relevant to your niche (e.g., Behance for designers, Contently for writers).

- Action: Choose one platform to start with and build out your basic professional presence. Include 2-3 samples of your best work (even if from past employment or personal projects initially).

9. Start Networking & Announce Your Business:

- Let your existing network (friends, family, past colleagues) know you're freelancing.

- Action: Send out personalized emails or messages. Post on LinkedIn. You never know where your first lead might come from!

10. Draft a Simple Service Agreement/Contract Template:

- Even for small projects, a basic contract protects both you and your client. It should outline scope, deliverables, payment terms, and timelines.

- Action: Find a reputable freelance contract template online (many free ones exist) and adapt it for your services. (Consider consulting a legal professional for this too).

Phase 3: Gaining Momentum & Building Habits (Days 61-90)

The third month is about actively seeking work, delivering quality, and establishing good business habits.

11. Actively Seek Your First Few Gigs:

- Don't wait for clients to find you initially.

- Action: Explore freelance job boards (Upwork, Fiverr, niche-specific boards), directly pitch to companies you admire, or follow up on leads from your networking. The goal is to land 1-3 small-to-medium projects to build experience and testimonials.

12. Deliver Excellent Work & Request Testimonials:

- Over-deliver on your first projects. Good communication and high-quality work lead to repeat business and referrals.

- Action: Once a project is successfully completed, politely ask your client for a testimonial or if they'd be willing to serve as a reference.

13. Refine Your Income/Expense Tracking System:

- As income starts coming in, ensure your tracking system is robust. Consider dedicated bookkeeping software if your spreadsheet is becoming cumbersome. (This is a good place to naturally mention affiliate tools if you have them on your site).

- Action: Review your tracking method. Explore tools like QuickBooks Self-Employed or FreshBooks.

14. Understand Basic US Tax Obligations:

- As a US freelancer, you'll likely need to pay quarterly estimated taxes (income tax + self-employment tax) to the IRS.

- Action: Research "IRS quarterly estimated taxes for freelancers." Understand the general deadlines and requirements.

- Disclaimer: This is not tax advice. Consult with a tax professional.

15. Review Your First 90 Days & Plan Ahead:

- What worked? What didn't? What did you learn?

- Action: Set goals for the next 90 days based on your initial experiences. Adjust your rates if necessary based on market feedback and your baseline calculation.

Launching your freelance business is a marathon, not a sprint. This 90-day checklist provides a strong starting structure, but the journey involves continuous learning and adaptation. By tackling these foundational steps, you'll be well on your way to building a successful and rewarding freelance career.

What are your biggest priorities in your first 90 days?

Share your thoughts in a quick message! Click Here