How Many Billable Hours Are Really in a Year? A Guide for Freelancers

Published on: by: Chip Olson

Most freelance businesses fail due to incorrect financial planning. A primary cause of this failure is basing an hourly rate on a 40-hour billable workweek. This assumption is a fundamental error.

Most freelance businesses fail due to incorrect financial planning. A primary cause of this failure is basing an hourly rate on a 40-hour billable workweek. This assumption is a fundamental error.

A full-time employee works approximately 2,080 hours per year. A freelancer does not. Your available billable time is significantly less because you are also running the business. An accurate rate requires an accurate calculation of your billable time.

This guide provides a standard model for calculating that number.

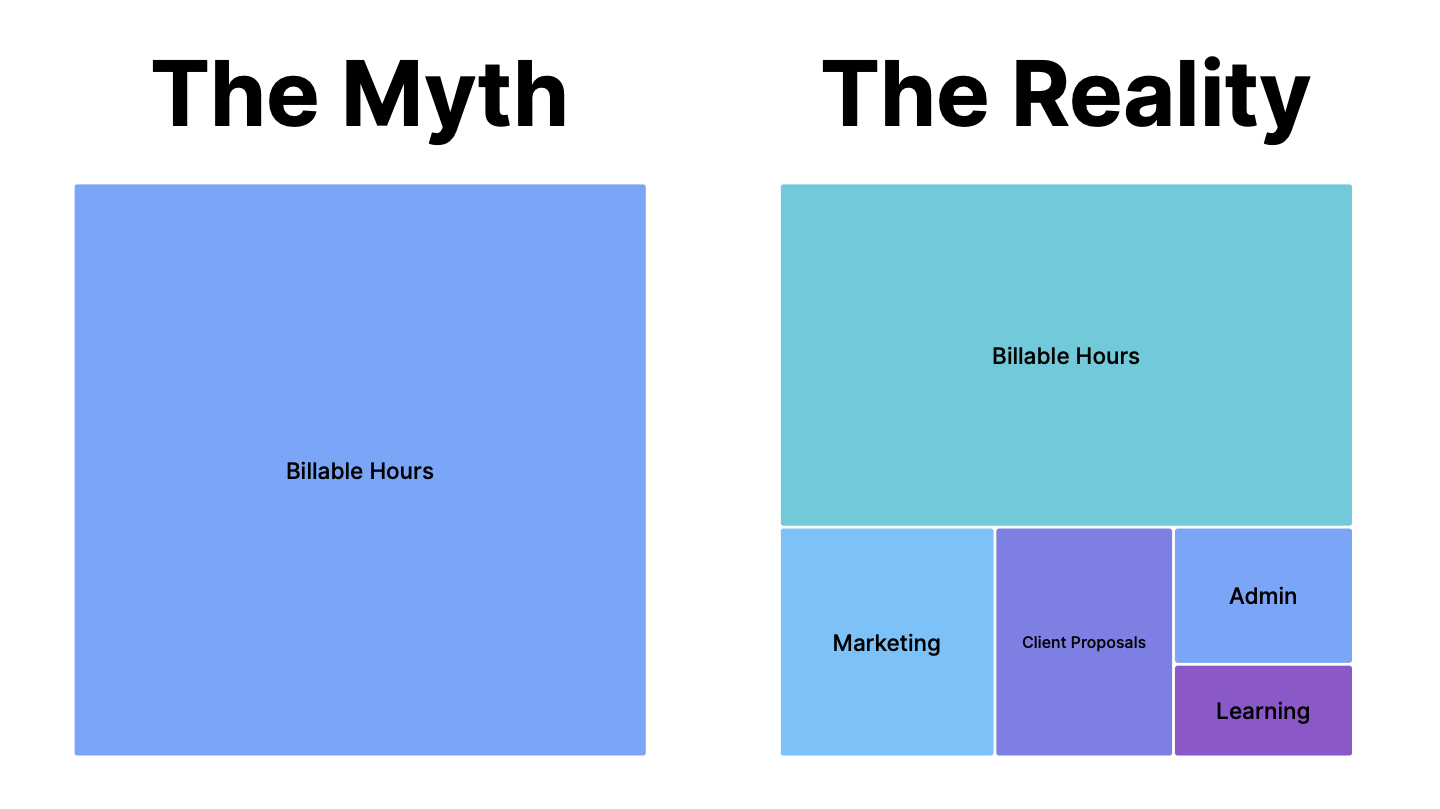

The Two Types of Freelance Time

Your time as a freelancer is divided into two categories. Understanding this distinction is critical for accurate financial planning.

-

Billable Time: This is time spent on work directly tied to a client project and for which you can invoice.

- Project execution (designing, writing code, consulting)

- Client meetings related to the project

- Revisions and feedback cycles

-

Non-Billable Time: This is time spent running your business. It is a necessary cost of doing business and must be factored into your rate.

- Marketing and sales

- Client prospecting and writing proposals

- Administrative tasks (invoicing, bookkeeping, email)

- Professional development and learning

- Networking

- Website and portfolio updates

Calculating Your Actual Billable Hours

Follow this three-step process to determine a realistic number for your annual billable hours.

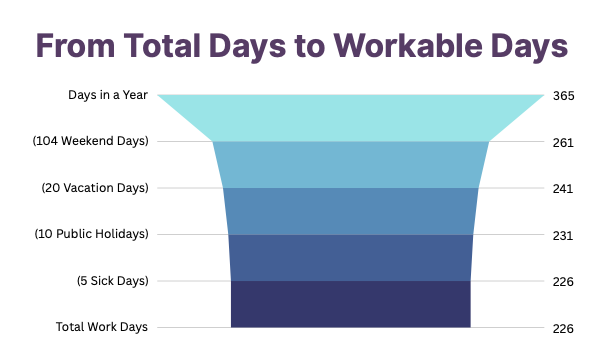

Step 1: Calculate Your Total Work Days

Start with the total days in a year and subtract all non-working days.

- Total Days in a Year: 365

- Subtract Weekends (52 x 2): -104

- Subtract Vacation Days (e.g., 4 weeks): -20

- Subtract Public Holidays (US standard): -10

- Subtract Sick/Personal Days (be realistic): -5

- Total Available Work Days: 226

Step 2: Estimate Your Non-Billable Time Percentage

A full-time freelancer spends a significant portion of their work time on non-billable tasks required to operate and grow the business.

- An established freelancer may spend 20-30% of their time on these tasks.

- A new freelancer seeking clients will realistically spend 40-50% of their time on marketing, sales, and administration.

For this calculation, we will use a conservative estimate of 30% non-billable time. This means only 70% of your time is available to be billed to clients.

Step 3: Calculate Your Annual Billable Hours

Use the numbers from the previous steps in this formula:

(Total Work Days × Hours Worked Per Day) × Billable Percentage = Annual Billable Hours

A standard calculation would be:

(226 Days × 8 Hours) × 70% Billable = 1,265.6 Billable Hours

Round this to a practical number: 1,260 billable hours. This is a realistic inventory of time you can sell in a year. It is significantly different from the 2,080 hours an employee works.

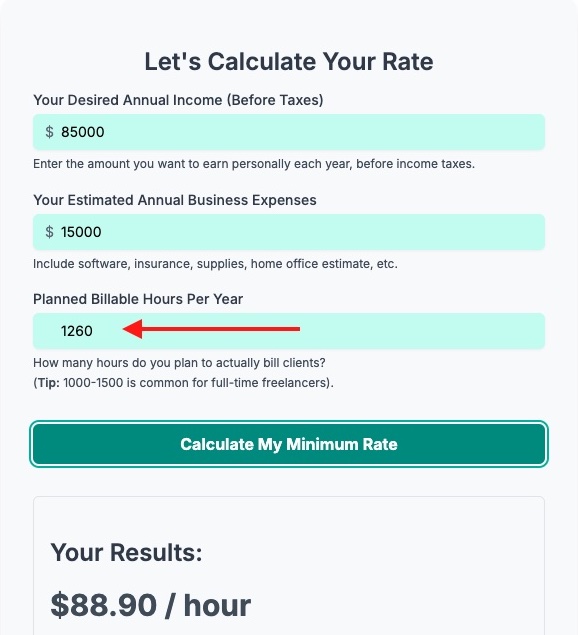

Applying This Number for an Accurate Rate

Our Freelance Hourly Rate Calculator is a tool, and a tool is only as effective as the data you provide.

Using an incorrect assumption like 2,000 billable hours will result in an hourly rate that is too low to sustain your business. It will fail to account for over 700 hours of necessary, unpaid work.

Take your calculated, realistic number (like 1,260 hours) and input it into the "Planned Billable Hours Per Year" field. This will provide a baseline rate grounded in reality.

Enter your realistic billable hours for an accurate baseline.

Conclusion

Your time is your inventory. An inaccurate inventory count leads to incorrect pricing and business failure. Stop using the 40-hour workweek assumption. Calculate your real numbers, set your rate with confidence, and build a profitable freelance operation.

- J.D. Roth